Thinking about using our credit facility? Here’s everything you need to know before making a decision and FAQs answered:

Having a credit account has massive benefits to customers like you. Firstly, by taking advantage of our generous 30-day credit terms, it allows you to plan and budget for upcoming payments, rather than being taken by surprise with a potential upfront payment for your accommodation. With a large percentage of bookings made a day or two in advance, there are very few hotels or self-catering accommodations that offer credit terms.

Signing up to direct debit allows even greater comfort in knowing when a payment will be made and by how much, allowing for even greater planning and budgeting!

One of the best features is that if you need to make a last-minute booking after the accounts team have finished work for the day, you can use your credit account. You can easily contact our 24/7 emergency support and book your travel or accommodation without having to disturb your accounts team to arrange a payment.

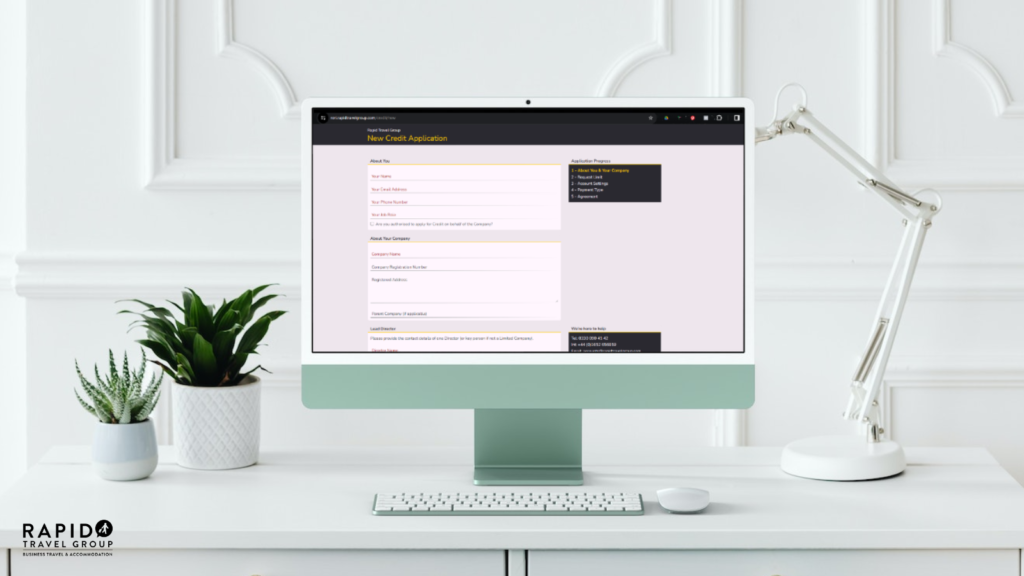

It’s actually really straightforward to get started with using our credit facility! Opening a credit account can be done in as quick as 20 minutes. Once all checks have been completed and approved, a credit agreement is sent out to be signed by you. As soon as this has been received back, the account is open and ready to use.

To start with just click here for our Credit Application Form! Or ask us for a Credit Application Form, by emailing us or giving us a ring (our contact info). Just fill in the form, click Submit at the bottom, and then we’ll get your company set up ASAP.

All invoices can be paid by debit or credit card. Through our payment provider Stripe we accept all major cards including American Express. We do charge a payment processing fee if paying by card; these vary depending on which card provider is being used, and you will be notified before payment is taken.

We now offer more flexible payment terms through our partner IWOCA; this will allow you to split your payment for up to 12 months, subject to approval and up to a maximum of £15,000. If suitable, this will allow even more flexibility on payments and ease the pressure on cash flow.

Although being a new business can have an impact on your credit rating, we do look at every aspect of the business. We don’t just say no because of your length of time trading. For example, we may offer a lower credit limit initially with a view to increase the limit at an agreed period if certain criteria have been met.

We aim to invoice you the Monday following the week of booking. If a booking is made on a Monday, this will be invoiced the following Monday, potentially increasing the payment terms by an extra 7 days.

If a booking is refundable and is cancelled, a credit note will be issued. This will then be deducted from the relevant invoice before payment is made. If your invoice has been paid before a credit is received, but your booking was cancelled or amended and a credit is due back to you, then this can be allocated to the next invoice due.

RAPID saves companies

money on their Business

Travel

& Accommodation

Book a virtual meeting with our team to talk about ways to improve your company's Travel & Accommodation.

Book a meeting arrow_forward_ios

We're specialists in a range of Industries; everything from Construction to Renewables, Shipping and Education!

Find out more arrow_forward_ios

Find out more about our service and see if it's the right fit for your company.

Find out more arrow_forward_ios

Our business is all about relationships; with our Clients, our Accommodation Providers, Suppliers, and Partners.

Find out more arrow_forward_ios